Options contract calculator

Example Youre presented with a call option to buy 100 shares in. For me this is the best way to manage risk size and the number of contracts historically called fixed fractional risk.

Selling Put Options Tutorial Examples

For more than 35 years we have been serving as a resource for options traders and anyone wanting to learn.

. This easy-to-use tool can be used to help you figure out what you could potentially make or lose on. An options contract is an agreement between two parties to facilitate a potential transaction on the underlying security at a preset price referred to as the. With this input the stock options calculator will be able to display your exact return target return and.

Customize your inputs or select a symbol and generate. Option value calculator Calculate your options value. Options Price Calculator Use the Options Price Calculator to calculate the theoretical fair value Put and Call prices Implied Volatility and the Greeks for any futures contract.

Spot Interest Right Strike Days Volatility Premium Amount Delta Gamma Vega Theta Rho Display settings. The LME Options Calculator generates theoretical prices and Greeks for any of LMEs options contracts. Your Free Options Prices calculator.

This stock option calculator computes can compute up to eight contracts and one stock position which allows you to pretty much chart most of the stock options strategies. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20. The goal is to enter contracts that let you buy shares for cheaper than what they rise to be worth by the expiration date.

Options Calculator is used to calculate options profit or losses for your trades. Options profit calculator will calculate how much you make and the total ROI with your option positions. Determine Your Risk Per Trade.

An options profit calculator like OptionStrat is used to find the potential profit and loss at various prices as well as show how your trade is affected by implied volatility IV time. The actual amount of ada received in rewards may vary and will depend on a number of factors including. Calculate the future options prices.

The long call calculator will show you whether or not your options are at the money in the money or out. Options involve risk and are not suitable for all investors. Staking CalculatorThe rewards predicted by this calculator are only an estimate.

Use our Futures Calculator to quickly establish your potential profit or loss on a futures trade. Trade Optimizer Options Calculator Trade Alert Variance Calculator. OptionStrats options profit calculator tool can help you quickly find the breakeven points and understand how the profit and loss of your position will change throughout the life of the option.

The options calculator is an intuitive and easy-to-use tool for new and seasoned traders alike powered by Cboes All Access APIs. This Option Profit Calculator Excel is a user contributed template will provide you with the ability to find out your profit or loss quickly given the stocks price moves a certain way. Only cumulative series Only option series.

Free connection to market data - automatically calculates historical volatility Calculate a multi-dimensional analysis The below calculator will calculate the fair market price the Greeks. How to use the LME Options Calculator Enter values into the calculators. Call Option Calculator is used to calculating the total profit or loss for your call options.

Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Simply enter any brokerage fees you will have for buying or selling options contracts.

Pricing Options Strike Premium And Pricing Factors Nasdaq

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

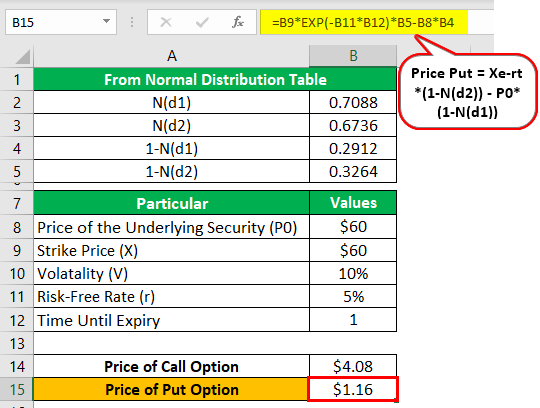

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Call Option Calculator Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Measure Profit Potential With Options Risk Graphs

Options M2m And P L Calculation Varsity By Zerodha

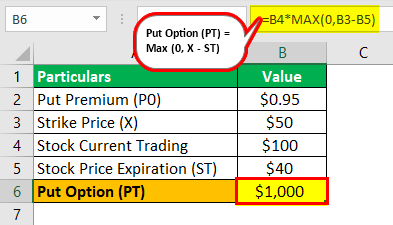

Put Option Meaning Explained Formula What Is It

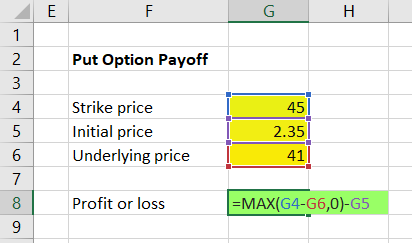

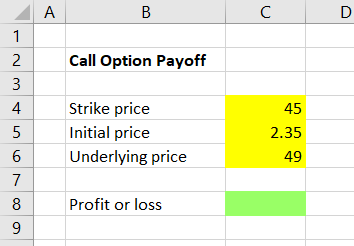

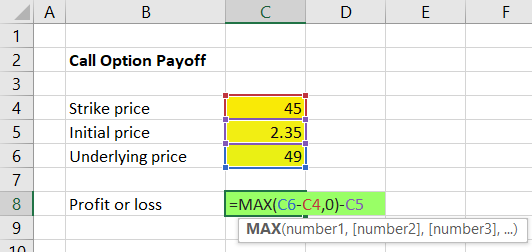

Calculating Call And Put Option Payoff In Excel Macroption

Calculating Call And Put Option Payoff In Excel Macroption

European Option Definition Examples Pricing Formula With Calculations

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Calculating Call And Put Option Payoff In Excel Macroption

Summarizing Call Put Options Varsity By Zerodha

Theta Varsity By Zerodha

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Options M2m And P L Calculation Varsity By Zerodha

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation